The Difference Between Cash and Profits

In my article, What You Really Need to Know About Cash Flow, I pointed out that most people think in terms of profits instead of cash.

In this article, I wrote:

Although cash is critical, people think in profits instead of cash. We all do.

When you imagine a new business, you think of what it would cost to make the product, what you could sell it for, and what the profits per unit might be. We are trained to think of business as sales minus costs and expenses, which is profits.

However, we don't spend the profits in a business. We spend cash. Profitable companies go broke because they had all their money tied up in assets and couldn't pay their expenses. Working capital is critical to business health.

Unfortunately, we don't see the cash implications as clearly as we should, which is one of the best reasons for proper business planning. We have to manage cash as well as profits.

From there I highlighted some key cash flow factors including sales on account, inventory, and paying bills.

The difference between cash and profits: A case study

In this article, I want to look at the implications in terms of a "real" business. The case is Garrett's Bike Shop, a bicycle store in a medium-sized local market, with sales of about $400,000 per year.

The first chart below shows key operating numbers for that store over a few months. You see sales, direct costs, expenses, and profits.

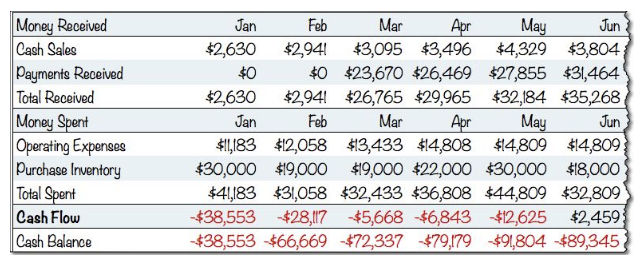

Now we compare that to a simple cash flow projection based on the assumption that the store makes 90 percent of its sales on account (to be paid later) and its customers wait two months to pay those invoices (hat would be unusual for a bicycle store, yes, but it's the common case for most existing business-to-business companies).

Also, let's assume Garrett keeps about a month's worth of sales as products in the store, called inventory, that customers can buy, and he has to buy those products in advance of selling them. The result is cash flow vastly different from profits, as you can see in the following illustration:

The difference between profits and cash, in this case, is more than $90,000 for a business selling about $30,000 monthly. That business would be profitable but bankrupt for lack of cash.

The change in the two scenarios is just cash flow, not a penny of sales, the cost of sales, or expenses. No prices are changed, no new employees added, and no changes made in salary.

Here's what that difference looks like graphically:

So, never forget: Profits are not cash.

No comments: